Here is a sure fire way to lose your genius status.

http://www.livescience.com/9008-marijuana-suppresses-immune-system.html

Saturday, October 22, 2016

Friday, October 21, 2016

Oil Ready for a Fall?

Over the next sixty days the oil market sells off on average 5%. This gives us a tremendous trading edge. We think that sell off started on Wednesday Night, and we plan to trade oil short until Thanksgiving.

The oil market has sold off every fall except one since 2007, and based on the market structure of the oil market looking out one year tells us speculators are now losing money holding oil off of the market. All of the land storage facilities around the world are at max capacity, and oil is being stored on ships. Storing oil on ships is very expensive. The price of oil one year later needs to be $10 higher to allow that trade to work. Right now it is up only $4. This is a recipe for disaster and oil needs to fall to $45-$6 to allow that trade to work again.

In fact, we just read that Nigeria is the first to concede this fact, and have dropped their price a dollar below spot. Others will follow. Also, the U.S. shale producers have just locked in a great deal of their production for next year at $15 over their costs. That means we will be producing flat out for the next six months.

We are recommending some very good trades that will net our subscriber 15-20% over the next two months. Get to know us a little better, watch our nightly videos, sign up for training on how to trade, and what to trade, get our insights into the month ahead, based on empirical data that generates profits, and sign up for our trade signals. Trade genius web page

The oil market has sold off every fall except one since 2007, and based on the market structure of the oil market looking out one year tells us speculators are now losing money holding oil off of the market. All of the land storage facilities around the world are at max capacity, and oil is being stored on ships. Storing oil on ships is very expensive. The price of oil one year later needs to be $10 higher to allow that trade to work. Right now it is up only $4. This is a recipe for disaster and oil needs to fall to $45-$6 to allow that trade to work again.

In fact, we just read that Nigeria is the first to concede this fact, and have dropped their price a dollar below spot. Others will follow. Also, the U.S. shale producers have just locked in a great deal of their production for next year at $15 over their costs. That means we will be producing flat out for the next six months.

We are recommending some very good trades that will net our subscriber 15-20% over the next two months. Get to know us a little better, watch our nightly videos, sign up for training on how to trade, and what to trade, get our insights into the month ahead, based on empirical data that generates profits, and sign up for our trade signals. Trade genius web page

Sunday, August 28, 2016

Ag Stocks Update

Please enjoy my video on all the AG ETF's.

https://www.youtube.com/watch?v=qJJp0rMpz-M&ab_channel=TradeGenius

https://www.youtube.com/watch?v=qJJp0rMpz-M&ab_channel=TradeGenius

Friday, August 26, 2016

A Start of Something Bigger?

Well after 5-6 Fed Governors telling us, yes are really going to raise rates this time, the market took notice. I guess the first tell was the Wednesday Biotech ambush, then the early rise then sell off on Thursday, and then of course the attack again today.

Right now I think the market must take Yellen at her word for a September rate increase, and for me that means more selling. I noted my thoughts on the charts below on entries. For sure I will steer clear of Biotech now through the election, and oil is soon to slip out of its buy window, so watching price and price levels to reenter long or not.

For me, 3-5% correction is not out of the question, and looking at volume areas 2128-2138 is the next area of interest, and 2104 is the top of the value area. Then 2053-2080, 1957, and 1914. so I will cool my heels some for a few weeks. Tactically, we are playing defense on Monday unless 2177.65 is taken out. I will adjust as necessary.

Gold and the miners are still trying to get a breakout but was rejected. It was interesting that gold didn't sell off with the market though, so hopeful that we rotate.

For volatility, the trade to short overbought is still on the table, but there was four higher highs in the past seven days so it gives me pause. The good news is out of these panic episodes if we get one are very profitable shorting opportunities.

Our NADEX EOD trades signal has been perfect for six straight weeks (30 trades). We had two days of loss, first was me rushing the trade, the second was me taking a second trade after we won (Stupid, greed kills with NADEX), the tie was me panicking. Overall, my expectations are you to double every six weeks starting with $500, trading 1 contract per $250 of capital. Our goal is to create a $5000 account within a year. Our rules and my NADEX booklet are on our website Trade Genius.

I will do a separate post on the Ag's, and my update on results, as well.

Enjoy the charts.

Right now I think the market must take Yellen at her word for a September rate increase, and for me that means more selling. I noted my thoughts on the charts below on entries. For sure I will steer clear of Biotech now through the election, and oil is soon to slip out of its buy window, so watching price and price levels to reenter long or not.

For me, 3-5% correction is not out of the question, and looking at volume areas 2128-2138 is the next area of interest, and 2104 is the top of the value area. Then 2053-2080, 1957, and 1914. so I will cool my heels some for a few weeks. Tactically, we are playing defense on Monday unless 2177.65 is taken out. I will adjust as necessary.

Gold and the miners are still trying to get a breakout but was rejected. It was interesting that gold didn't sell off with the market though, so hopeful that we rotate.

For volatility, the trade to short overbought is still on the table, but there was four higher highs in the past seven days so it gives me pause. The good news is out of these panic episodes if we get one are very profitable shorting opportunities.

Our NADEX EOD trades signal has been perfect for six straight weeks (30 trades). We had two days of loss, first was me rushing the trade, the second was me taking a second trade after we won (Stupid, greed kills with NADEX), the tie was me panicking. Overall, my expectations are you to double every six weeks starting with $500, trading 1 contract per $250 of capital. Our goal is to create a $5000 account within a year. Our rules and my NADEX booklet are on our website Trade Genius.

I will do a separate post on the Ag's, and my update on results, as well.

Enjoy the charts.

Wednesday, July 27, 2016

China is Drowning

China is getting utterly inundated with rain. The most in 20 years. This was predictable as this happens after every El Nino event as strong as we had. What follows is a blow up in grain prices. They have been subdued due to record stockpiles around the world, but that is ending.

Four of the 7 biggest producers of grain worldwide are having massive shortfalls, and the world is slow to pick up on it. We are and will continue to buy grains; Wheat and Corn.

35% of China's corn production is now under water or in saturated ground. 50% of France's wheat harvest is gone, and Brazil's corn crop suffered 25% losses. We have look out the backyard bias in the U.S., but any inkling of a shortfall here will send prices skyward. But, at any rate prices will rise from here, and there is little the Federal Reserve can do to stop it, as China and Brazil must import grains to keep their population and livestock's fed.

Four of the 7 biggest producers of grain worldwide are having massive shortfalls, and the world is slow to pick up on it. We are and will continue to buy grains; Wheat and Corn.

35% of China's corn production is now under water or in saturated ground. 50% of France's wheat harvest is gone, and Brazil's corn crop suffered 25% losses. We have look out the backyard bias in the U.S., but any inkling of a shortfall here will send prices skyward. But, at any rate prices will rise from here, and there is little the Federal Reserve can do to stop it, as China and Brazil must import grains to keep their population and livestock's fed.

| French wheat crop to fall even more than thought | |

French wheat production will fall even steeply more this year than many had forecast, according to the results of a crop tour by Paris-based consultancy Agritel.

In its first forecast for the coming harvest in the EU's top wheat grower, Agritel pegged expectations at 37.26m tonnes, a fall of 9.2% year on year

European grain industry group Coceral last week forecast the French wheat crop at 38.87m tonnes.

Last month the French agricultural consultancy Strategie Grains forecast French wheat production at 38.5m tonnes, while ODA last month saw the French crop at 36.5m-38.5m tonnes.

An Agritel analyst told Agrimoney the forecast was based on the results of a crop tour in late June, and could be revised later in the season to take in further weather developments.

The group also noted "disappointing" early results, in quality and yield terms, from France's harvest of barley, which having a shorter growing season than wheat is reaped earlier.

| |

Friday, July 15, 2016

Tuesday, July 12, 2016

Hot Weather and Dry soil makes for Shriveled Corn

We are about to repeat a pattern in the U.S. Midwest that Brazil just completed. Hot and dry weather in the corn belt on top of dry soil moisture. Brazil went from a major exporter to an importer and a crop estimate that has now fallen 25%. They expected a near record crop, just like us.

This is from my friends over at Weathertrends360. I encourage everyone to follow them on FaceBook. They will save you from financial hardship.

The parallels to what happened in Brazil are eerily similar. The simple math suggests the sum of the parts don't add up to these rosy USDA guesstimates. TX and Deep South crops getting fried, MI fried, N IN - OH has issues, W KY - S IN too wet. 4-weeks of heat/drought like stress in WCB in June and now dome of death coming and likely to stick around for a few weeks starting next week. It's been a weather market all year and only going to get worse. Eventually real data like this will come to light.

Here is his soil Moisture chart.

Here are the weather trends for the Midwest. Both the U.S. and the Euro models agree.

https://www.facebook.com/weathertrends360/videos/1232002913479240/

This should move corn and wheat higher.

This is from my friends over at Weathertrends360. I encourage everyone to follow them on FaceBook. They will save you from financial hardship.

The parallels to what happened in Brazil are eerily similar. The simple math suggests the sum of the parts don't add up to these rosy USDA guesstimates. TX and Deep South crops getting fried, MI fried, N IN - OH has issues, W KY - S IN too wet. 4-weeks of heat/drought like stress in WCB in June and now dome of death coming and likely to stick around for a few weeks starting next week. It's been a weather market all year and only going to get worse. Eventually real data like this will come to light.

Here is his soil Moisture chart.

Here are the weather trends for the Midwest. Both the U.S. and the Euro models agree.

https://www.facebook.com/weathertrends360/videos/1232002913479240/

This should move corn and wheat higher.

Saturday, July 9, 2016

Hot July good for Corn and Wheat Prices

The USDA put out a crop report that is notoriously optimistic, and devoid of any historical context of the upcoming La Nina climate pattern. The result was a raid on corn and wheat prices just as the farmers are bringing in their crops. For those of us that are familiar with the bullion bank raids, this is the Ag version.

However as expected, the July pattern is turning hot and dry with low moisture content in the soil from a relatively hot and dry June. This is causing a short covering rally in the grains, and at the same time Brazil announces that their corn harvest will be down 25% from forecast, and in France they keep lowering quality and quantity estimates. Last month China announced a big write down of their wheat harvest, now expecting it to be 30% less than expected. Why? excessive rains, and since then it has not stopped raining.

Remember countries and big banks and Food processors want prices cheap and they own the means of communications, but they can't hide the weather very long. La Nina lasts usually two years, and this one will be strong as those follow strong El Nino's usually are. This time we are going to get a boost of cold from both oceans cooling due to their 30 year cycles, and the sun going quiet.

This will magnify the intensity and will drive grain prices much higher. As a side effect, it will kill the Central Banks around the world moves to debase, as it has on the last three strong La Nina's (1999-2000, 2007-2008, and 2011-2012).

We are holding JO, DBA, JJG, WEAT, and Corn (through futures) long term. We also give out a swing trade of buy and sell if you want to more actively manage your position size and drive your cost basis down. www.tradegenius.co)

Make no mistake food prices are going much higher, that is a mathematical certainty.

My video on buy and sell signals on the Ag Stocks.

Below are some news excerpts from Agrimoney and some maps from Weathertrends360.

www.agrimoney.com

https://www.facebook.com/weathertrends360/?fref=ts

However as expected, the July pattern is turning hot and dry with low moisture content in the soil from a relatively hot and dry June. This is causing a short covering rally in the grains, and at the same time Brazil announces that their corn harvest will be down 25% from forecast, and in France they keep lowering quality and quantity estimates. Last month China announced a big write down of their wheat harvest, now expecting it to be 30% less than expected. Why? excessive rains, and since then it has not stopped raining.

Remember countries and big banks and Food processors want prices cheap and they own the means of communications, but they can't hide the weather very long. La Nina lasts usually two years, and this one will be strong as those follow strong El Nino's usually are. This time we are going to get a boost of cold from both oceans cooling due to their 30 year cycles, and the sun going quiet.

This will magnify the intensity and will drive grain prices much higher. As a side effect, it will kill the Central Banks around the world moves to debase, as it has on the last three strong La Nina's (1999-2000, 2007-2008, and 2011-2012).

We are holding JO, DBA, JJG, WEAT, and Corn (through futures) long term. We also give out a swing trade of buy and sell if you want to more actively manage your position size and drive your cost basis down. www.tradegenius.co)

Make no mistake food prices are going much higher, that is a mathematical certainty.

My video on buy and sell signals on the Ag Stocks.

Below are some news excerpts from Agrimoney and some maps from Weathertrends360.

www.agrimoney.com

https://www.facebook.com/weathertrends360/?fref=ts

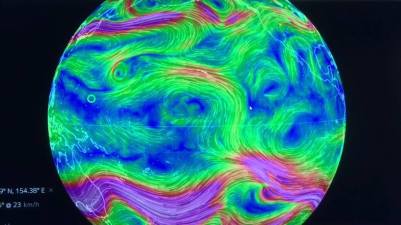

Summer-to-Date Classic La Niña Around the World

July 7th, 2016 | wt360

Meteorological Summer is considered 1 June - 31 August so we're 41% done...the Sun say's we're only day 17 into Summer (21 June - 22 September). While NOAA hasn't officially declared it a La Niña Summer yet, the Summer weather pattern around the world is classic La Niña and we can prove it.

Here in the U.S. Summer has been the hottest on record to date with rainfall the least in 4 years and 3rd least in 28 years.

The number of really hot days over 90F across the U.S. is the 2nd most in 25 years.

This has drought expanding in parts of the Central U.S. and especially so in the Southeast, Great Lakes and Northeast.

Looking at the ocean temperatures compared to this time last year we see a wholesale change from emerging record strong El Niño to now emerging La Niña.

Below the surface of the entire Equatorial Pacific Ocean from Australia to Ecuador we see hundreds of feet of much below normal water temperatures suggesting this La Niña event will go well into 2017.

Looking around the world shows classic La Niña with Southeast Asia going from a multi-year El Niño drought to the wettest conditions in 22 years. Australia droughts to wettest in 25+ years. West Africa wettest in over 25 years while the U.S. overall enters a dry pattern. The wet weather in Africa bodes well for a very active core hurricane season for the U.S. so strap in for some potentially major storms in the August - October time-frame.

The coldest weather in 25+ years is hitting the Northwest Rocky Mountains which is also a classic sign of La Niña while the Central and Eastern U.S. is about to bake big-time with the 2nd hottest mid-July heat-wave in 28 years.

For our farmer friends...keep the faith. Brazil CONAB just came out today (7 July 2016) with huge news that their Safrinha yields just plummeted another 14% from last month's bleak update that was already off 11%. They are now down a whopping 25% off yield projections issued back in March! That should rattle the world commodity markets as now the U.S. can not so much as have a hiccup on yields and we will have a big one! Brighter days ahead for America's Farmers! God Bless You - Keep the Faith!

- Capt Kirk out.

Here in the U.S. Summer has been the hottest on record to date with rainfall the least in 4 years and 3rd least in 28 years.

The number of really hot days over 90F across the U.S. is the 2nd most in 25 years.

This has drought expanding in parts of the Central U.S. and especially so in the Southeast, Great Lakes and Northeast.

Looking at the ocean temperatures compared to this time last year we see a wholesale change from emerging record strong El Niño to now emerging La Niña.

Below the surface of the entire Equatorial Pacific Ocean from Australia to Ecuador we see hundreds of feet of much below normal water temperatures suggesting this La Niña event will go well into 2017.

Looking around the world shows classic La Niña with Southeast Asia going from a multi-year El Niño drought to the wettest conditions in 22 years. Australia droughts to wettest in 25+ years. West Africa wettest in over 25 years while the U.S. overall enters a dry pattern. The wet weather in Africa bodes well for a very active core hurricane season for the U.S. so strap in for some potentially major storms in the August - October time-frame.

The coldest weather in 25+ years is hitting the Northwest Rocky Mountains which is also a classic sign of La Niña while the Central and Eastern U.S. is about to bake big-time with the 2nd hottest mid-July heat-wave in 28 years.

For our farmer friends...keep the faith. Brazil CONAB just came out today (7 July 2016) with huge news that their Safrinha yields just plummeted another 14% from last month's bleak update that was already off 11%. They are now down a whopping 25% off yield projections issued back in March! That should rattle the world commodity markets as now the U.S. can not so much as have a hiccup on yields and we will have a big one! Brighter days ahead for America's Farmers! God Bless You - Keep the Faith!

- Capt Kirk out.

| PM markets: has fund selling run its course? | |

The US Midwest continues to be the focus of grain markets, as corn and soybean futures bounced back on some hotter weather outlooks.

And with funds winding up long positions over the last couple of sessions, analysts suggested that short covering was coming to the fore.

"Short covering has been the rule of the day after another washout of fund longs yesterday, (especially in the soybean complex)," said Darrell Holaday, at Country Futures.

Has fund selling run its course?

Weekly Commitment of Traders data from the Commodity Futures Trading Commission, to be released after markets close, will shed light on fund position in the week to Tuesday, giving a clue as to the hedge fund activity that has been driving markets.

Brian Henry, at Benson Quinn Commodities, said that the "strong recovery in soybeans hints at the idea that the fund selling of the last week has run its course".

But, he commented that "the idea that the funds have liquidated enough length at this point has merit, but we really haven't seen the types open interest reductions the trade is looking for".

Heat raises US concerns

As well as fund positioning, corn and soybeans are benefiting from a less benign weather outlook for the US Midwest.

"Extended forecast maps continue to fluctuate on heat and expected rainfall, causing wild swings in ag commodities," said Paul Georgy, at Allendale.

"The volatility will continue until trade gets a better grasp on the remainder of summer's weather," he warned.

Export sales beat expectations

Soybean sales got a boost from better-than-expected US export sales.

"Soybean sales were mediocre in both marketing years, said Joe Lardy, at CHS Hedging.

US soybean sales for the 2015-16 season were 637,300 tonnes above the top end of expectations.

Sales in the 2016-17 were in-line with expectations, at 585,700 tonnes.

November soybean futures bounced up from two-month lows, to finish at $10.57 ¾ a bushel, up 3.2% a day.

Heat pushes corn higher

US corn export sales for the 2015-16 marketing year were well short of expectations, at just 369,700 tonnes, compared to analyst expectations of 500,000 to 700,000 tonnes.

New crop export sales were in line with expectations, at 443,300 tonnes. Combined old crop and new crop sales were the lowest for 10 weeks.

But fund short-covering and forecast US heat pushed prices higher.

December corn futures finished up 4.2% at $3.62 ½ a bushel, the highest close in the week.

Low prices stir buying interest

Wheat export sales were reported at 825,300 tonnes, well ahead of analyst expectations.

Total wheat commitments for the 2016-17 marketing year now stand 8.5m tons, 36% ahead the same time last year.

Mr Holaday said the wheat sales were "maybe some sign that extremely low prices starting to stir some significant interest".

September Chicago wheat futures finished up 2.5%, at $4.35 a bushel.

French wheat gets another downgrade

FranceAgriMer cut ideas of the French wheat crop to 59% good or excellent as of July 4, down 6 points from last week.

This leaves crop ratings at a five-year low for this time of year.

French wheat ratings are plummeting, after unwanted heavy rain in much of the country.

December wheat futures in Paris rose 2.3%, to E163.75 a tonne.

Good sales lift cotton

Cotton futures rallied, after heavier than expected US export sales.

Weekly US cotton export sales were reported at 201,900 running bales, over three times the pace of last week's sales.

December futures settled up 1.0%, at 65.81 cents a pound.

| |

Sunday, July 3, 2016

They Lie, They Profit, We Pay

Same as it ever was. There are a lot of Countries, Politically connected Traders (Brokerage Houses), and Banks desperate to keep the price of oil high. One only need to take a look at Venezuela to see what the future looks like in OPEC land. But not just countries, banks from around the world lent freely to oil producers and oil needs to be at much higher price than currently to ensure repayment.

Enter the Brokers, many owned by the same banks who made these loans, and the industry, who creates the numbers that drives the price. If only those numbers can be made to be more optimistically than reality, and the futures traders could key on that with leverage to drive the price of oil higher. Well it seems like that is indeed what happened, and now the data is catching up, right at the same time oil demand gets even weaker.

So I expect a sharp fall off in the price of oil the remainder of summer, and if I am right regarding Atlantic Hurricane season being weak, again. The price drop can continue through the fall.

Enter the Brokers, many owned by the same banks who made these loans, and the industry, who creates the numbers that drives the price. If only those numbers can be made to be more optimistically than reality, and the futures traders could key on that with leverage to drive the price of oil higher. Well it seems like that is indeed what happened, and now the data is catching up, right at the same time oil demand gets even weaker.

So I expect a sharp fall off in the price of oil the remainder of summer, and if I am right regarding Atlantic Hurricane season being weak, again. The price drop can continue through the fall.

America's "Soaring" Gasoline And Oil Demand Was Just An Illusion: How The EIA Fooled The Algos

by Tyler Durden

Jul 3, 2016 1:45 PM

When it comes to "real-time" measurements of crude demand and supply, the data is notoriously bad (and perhaps, according to some, intentionally manipulated). We pointed this out most recently in early March when we that according to IEA data, crude oil production exceeded consumption by an average of 0.9 million barrels per day in 2014 and 2.0 million bpd in 2015. Of this 1 billion barrels which the IEA said was produced but not consumer, some 420 million are said to be stored on land in OECD member countries and another 75 million can be found stored at sea or in transit by tanker somewhere from the oil fields to the refineries. This means that as of this moment, about 550 million "missing barrels" are unaccounted for "apparently produced but not consumed and not visible in the inventory statistics."

Wednesday, June 29, 2016

Climate's Gone Crazy

Please read below. The solar minimum is here and it will be disruptive. Buy food ETF's, and stock up. It will get nasty.

From Paul Beckwith's Twitter feed

From Paul Beckwith's Twitter feed

"Our climate system behavior continues to behave in new and scary ways that we have never anticipated, or seen before."

This scary stuff. I am sure it happened last solar minimum tto, but we had no way of knowing it.

From a mainstream Aussie Newspaper

The sun has gone blank twice this month. This is what it means

news.com.au

YOU may not have noticed but our sun has gone as blank as a cue ball. As in, it’s lost its spots.

According to scientists, this unsettling phenomenon is a sign we are heading for a mini ice age.

Meteorologist and renowned sun-watcher Paul Dorian raised the alarm in his latest report, which has sparked a mild panic about an impending Game of Thrones-style winter not seen since the 17th century.

Sunday, June 26, 2016

And more bad news for Brazil.

| Glass half full... is an orange juice shortage on the cards? (From Agrimoney site) | |

Brazilian orange juice production and exports will drop sharply to 26-year lows, due to widespread heat damage to the crop, US officials said.

The USDA's Sao Paolo bureau slashed its ideas of production in the world's largest orange juice exporter, citing hot dry weather last year.

"The Sao Paulo [state] commercial citrus belt was negatively affected by usually hot temperatures during fruit setting," the bureau said.

Significant damage

The Brazilian orange crop over the year to July 2017 is forecast at 351.7m 40.8 kilograms boxes, down 14% from the previous crop.

The bureau cited "weather-related problems during blossoming and fruit setting".

"In spite of the good and steady blossoming from late August through October, the higher than normal temperatures during September and October significantly damaged fruit setting, thus reducing production potential," said the bureau.

It looks like there is a potential $10K per contract possible over the next year, and this La Nina is scheduled to be the worst on record.

Problems can be profits if you know where to look. Let us help you

| |

Brazilian Corn in Trouble

| US officials cut Brazil corn hopes - and warn of further downgrades (From Agrimoney's site) | |

Brazil's corn imports will soar five-fold to a 16-year high, thanks to the supply squeeze prompted by a disappointing safrinha crop, US officials said, cutting their harvest forecast and flagging "great challenges" for livestock farmers.

Brazil, better known as the second-ranked corn exporter, will see its imports swell from 330,000 tonnes last season to 1.5m tonnes in 2015-16, the US Department of Agriculture's Brasilia bureau said, the kind of volumes more typically bought by the likes of Egypt, Israel or Turkey.

Imports at that level would be the biggest since 1999-2000, besides being ahead of the 1.1m tonnes that the USDA has officially forecast, and the 1.0m tonnes expected by Conab, Brazil's own crop bureau.

The raised estimate reflected a weaker forecast for Brazilian corn production, which the bureau pegged at 75.0m tonnes, below the USDA's official 77.5m-tonne figure, and the 76.2m tonnes expected by Conab.

First the French, German and Argentinians take a big hit on their Wheat crop. Then the Chinese soft wheat crop estimates drop to as high as a 30% loss.

See my video here.

Now the Brazilians, reeling from weak sugar and Coffee harvests are dealing with their corn crops. They will swing from a net exporter to a net importer this year, and to make matters worse they will have a livestock deficit, as well.

This is La Nina, and it is just getting started.

CORN is cheap here, and it is not going to get any cheaper. Bottom is already in. The risk/reward is spectacular. We have many other great set ups. We are already over 100% for the year, and the second half will prove to be most profitable.

Join us at www.tradegenius.co

Enjoy the chart.

| |

Wednesday, June 22, 2016

Buy WEAT

| |||

| 'Exceptionally wet month' cuts hopes for French, German wheat | |||

Strategie Grains cautioned over potential hiccups to European Union wheat exports to key markets as, citing an "exceptionally wet month", it cut French and German production forecasts, and warned over quality too.

The consultancy cut by a combined 1.3m tonnes its forecast for the soft wheat harvests in France, the EU's top producing country, and in second-ranked Germany, citing poor weather.

"After an exceptionally wet month of May with much less sunshine than normal… we have reduced our yield estimates for the winter cereals in the affected regions of France and Germany," Strategie Grains said.

Separately, rival consultancy Agritel said that "in France and in Europe globally, rains are still heavily present, increasing the disease concern".

China Rain Seen Damaging Crop Output, Quality

JUNE 21, 2016 06:31 AM

China’s wheat may face being downgraded to feed quality and output could drop to a five-year low after persistent rain damaged crops in the world’s top producer and consumer, according to analysts.

Higher-than-normal rainfall in April and May soaked crops in the provinces of Jiangsu, Anhui and Hubei, analysts at Shanghai JC Intelligence Co. and Beijing Orient Agribusiness Consultant Ltd. said. Heavy rain last month also damaged crops being harvested in parts of Henan, the country’s top wheat grower, the analysts said.

“Yields this year may be the worst in many years, as well as quality,” said Ma Wenfeng, an analyst with Beijing Orient. Heavy rains in March and April, coupled with higher-than-normal temperatures, also caused widespread disease in Jiangsu and Anhui, the country’s soft-wheat growing region, he said.

China’s winter wheat harvest, which accounts for more than 90 percent of total output, is set to finish this month. About 10 million metric tons could be downgraded to feed use and output in the 2016-17 season may fall to a five-year low of 107 million tons, said Shi Wei, an analyst with Shanghai JC Intelligence. China harvested a total of 130 million tons of wheat last year, up 3.2 percent from a year earlier, according to the National Bureau of Statistics.

The strong El Nino weather event, which ended last month, caused more frequent rainfall in spring, including 16 rounds of heavy rains in April and May, Zhou Bing, an official at China’s National Climate Center said at a press conference earlier this month. China’s agriculture ministry said this month that it was expecting a bumper wheat harvest, without giving a production forecast.

A quote from a farmer 3 weeks of 85-95 temps daily and no rain. Corn is rolling daily! We had 11" of rain from April 17th to May 30th. Planted corn in terrible conditions. Look at drought monitor map from last week. Then compare it to this week. Wow! Some of the highest producing areas of the corn belt show abnormal dryness. Area doubled in size. This is how droughts start. Quickly! Maybe Captain Kirk Weather Trends 360 knows what he is talking about. So far he is scary accurate. USDA is Absolutely Delusional on the State of the Corn Crop!June 21st, 2016 | wt360

This blog is for the thousands of farmers in panic mode because the USDA is completely delusional on the health of the corn crop sending prices in a tail spin. First...STAY CALM...never do anything in a panic and don't sell the farm...prices will soar in the weeks ahead.

Second - the US GFS short range model has way over forecast cool and wet all June long and we're ending up with the hottest June in 22 years across the Corn Belt and rainfall 51% below average for the first 3 weeks so PLEASE DON'T BITE ON THE COLDER/WETTER PATTERN - very unlikely - and the Euro model agrees. Third - we bought MORE Sept and Dec call options as there is little doubt we're headed for a scorching hot/dry Summer. Let's go back to this date in 2012...the weather pattern is eerily similar as is the USDA's nonsense. At this point in the 2012 season all was good per USDA despite a hot/dry June and Corn prices were down 14% year-to-date as of middle June 2012. Here we go again!!!! Then we had the hottest/driest July in decades...wt360 projects the 2nd hottest/driest only to 2012 so hang in there...the rally will almost certainly explode in July!  | |||

Saturday, May 21, 2016

It Continues

This is the Black Swan. The weather has begun to affect food production worldwide. This is the news in just the last two weeks.

In South America, their harvests have been affected by cool, rainy weather.

In India, it is drought,

In Africa, drought.

China's wheat growing regions is under snow (8 inches this week), their rice growing region is under cool, rainy weather, and their corn region is, as well.

The United States is not immune either. Late snow hit the Maine and the Idaho potato regions, Continual rainfall is hitting the upper Ohio valley, allowing only 8% of the corn crop to be put into the ground, and in the Midwest hail storms last week destroyed 10's of thousands of acres of corn and wheat.

Now the U.S. government can no longer hide this fact and are calling for falling temps for the back half of the year, and this might be the biggest La Nina on record. About time they are catching up.

I discussed The reasons why are in a ebook I wrote on this very subject. It is free, and it will help you survive and thrive in this coming decade.

My website , Just scroll down and request it.

Back to the black swan; rising food prices ties the Central Bankers hands as their only game is devaluation and you can't devalue when importing food during a deficit will kill your economy and/or your populations will starve. Remember the 2008 rice scare, and the 2011 Arab Spring? That is coming to nearly every country from now through the coming decade. Buy Ag ETF's to hedge these events. Don't be like this guy.

In South America, their harvests have been affected by cool, rainy weather.

In India, it is drought,

In Africa, drought.

China's wheat growing regions is under snow (8 inches this week), their rice growing region is under cool, rainy weather, and their corn region is, as well.

The United States is not immune either. Late snow hit the Maine and the Idaho potato regions, Continual rainfall is hitting the upper Ohio valley, allowing only 8% of the corn crop to be put into the ground, and in the Midwest hail storms last week destroyed 10's of thousands of acres of corn and wheat.

Now the U.S. government can no longer hide this fact and are calling for falling temps for the back half of the year, and this might be the biggest La Nina on record. About time they are catching up.

I discussed The reasons why are in a ebook I wrote on this very subject. It is free, and it will help you survive and thrive in this coming decade.

My website , Just scroll down and request it.

Back to the black swan; rising food prices ties the Central Bankers hands as their only game is devaluation and you can't devalue when importing food during a deficit will kill your economy and/or your populations will starve. Remember the 2008 rice scare, and the 2011 Arab Spring? That is coming to nearly every country from now through the coming decade. Buy Ag ETF's to hedge these events. Don't be like this guy.

Wednesday, May 18, 2016

Best Stock Sector to Buy in June

Starting next week it is time to think about the trades for June, and the research I have compiled tells me that June is a relatively weak month (Second worst) and that there is only one sector that is green.

That sector is utilities. Specifically XLU. The good news is XLU is now pulling back, and will give us good entry point over the next couple of days.

That sector is utilities. Specifically XLU. The good news is XLU is now pulling back, and will give us good entry point over the next couple of days.

Monday, May 16, 2016

Just Wow - World Famine Watch on the table?

Maine's potato crop is in jeopardy as a late spring snowstorm is hitting Northern Maine. A record snowstorm, on top of a record year, on top of three prior record setting years.

La Nina Pattern is intact

The world will not be immuned

Hail crushing the grains in the Midwest last week

Subscribe to:

Posts (Atom)

PRINTABLE VERSION

PRINTABLE VERSION EMAIL TO A FRIEND

EMAIL TO A FRIEND RSS FEEDS

RSS FEEDS