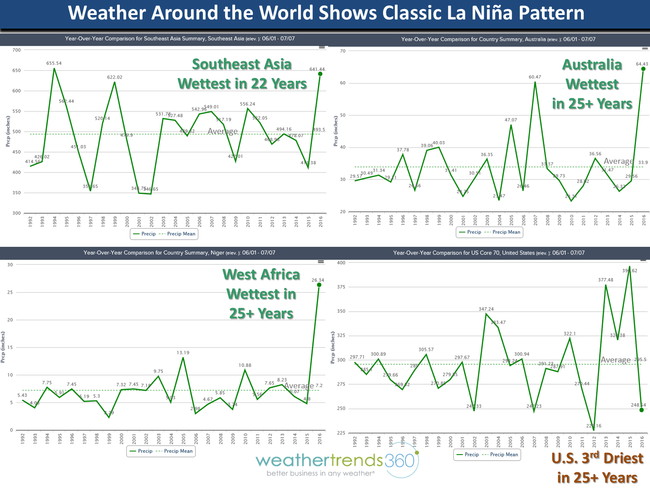

Four of the 7 biggest producers of grain worldwide are having massive shortfalls, and the world is slow to pick up on it. We are and will continue to buy grains; Wheat and Corn.

35% of China's corn production is now under water or in saturated ground. 50% of France's wheat harvest is gone, and Brazil's corn crop suffered 25% losses. We have look out the backyard bias in the U.S., but any inkling of a shortfall here will send prices skyward. But, at any rate prices will rise from here, and there is little the Federal Reserve can do to stop it, as China and Brazil must import grains to keep their population and livestock's fed.

| French wheat crop to fall even more than thought | |

French wheat production will fall even steeply more this year than many had forecast, according to the results of a crop tour by Paris-based consultancy Agritel.

In its first forecast for the coming harvest in the EU's top wheat grower, Agritel pegged expectations at 37.26m tonnes, a fall of 9.2% year on year

European grain industry group Coceral last week forecast the French wheat crop at 38.87m tonnes.

Last month the French agricultural consultancy Strategie Grains forecast French wheat production at 38.5m tonnes, while ODA last month saw the French crop at 36.5m-38.5m tonnes.

An Agritel analyst told Agrimoney the forecast was based on the results of a crop tour in late June, and could be revised later in the season to take in further weather developments.

The group also noted "disappointing" early results, in quality and yield terms, from France's harvest of barley, which having a shorter growing season than wheat is reaped earlier.

| |